Créateur d’informations Foodservice

GIRA Foodservice has been updating every 3 years a multi client study about the structure of the Foodservice Market in Portugal. Our newly published study gives an overview of the Foodservice market in Portugal based on 2011/2012 key facts & figures as well as future trends up to 2015.

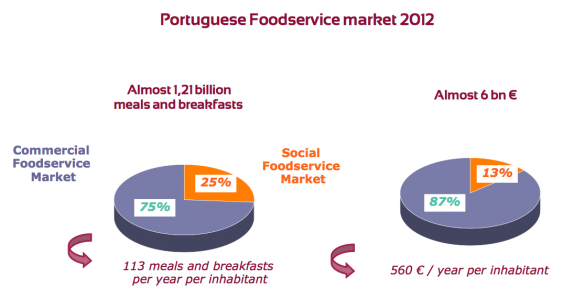

In terms of value, 560 euros are spent each year on eating out of home per inhabitant. Almost 87% of the total value are generated by the Commercial Foodservice market.

The meals which are consumed out of home represent over 10% of all meals eaten by Portuguese people, i.e. an average of 113 meals and snacks per year per inhabitant, which gives another ratio of 2,17 meals per week.

By considering future trends up to 2015 in the Social Foodservice market, positive growth is forecast in almost all segments with the exception notably of B&I where the increase will be slower. The factors explaining this evolution are: austerity measures implemented by the Troïka mission, further reduction of the number of employees working in industrial and services sites at least up to 2013-2014, stability in the Education sector more or less balanced by an extension of non-compulsory pre-schooling education and the reinforcement of tertiary education in spite of a decreasing birth rate, in the Healthcare sector, the number of hospital days is likely to increase logically over the coming years, in the Welfare sector, growth prospects are positive, especially in the context of demographic trends towards an ageing population in Portugal…

The Commercial Foodservice market is likely to register positive growth rates again from the end of 2013-2014 onwards, both 2012 and 2013 years being the worst period of time. The various sectors of the commercial foodservice market will develop in different ways : independent traditional restaurants (family businesses) will be the type of operators who will most suffer from the unfavorable situation. On the contrary, take away concepts will be less hit by the negative environment that commercial foodservice has to face with, and they may further register a growth of sales. The foodservice sectors that will register the highest average annual growth rates between 2012 and 2015 are the Hotel & Lodging market, the Leisure & Event Catering market as well as QSR and Transport Foodservice.

Restaurant chains are likely to register a decrease in their activity since these operators are subject to the same market conditions like the independent operators. Large foodservice groups will have to adapt specific strategies at very short term to counter the loss in frequentation.

The contract caterers will increase their business by over 8 million meals up to 2015. Over 81% of the growth of the number of meals will come from the Welfare segment.

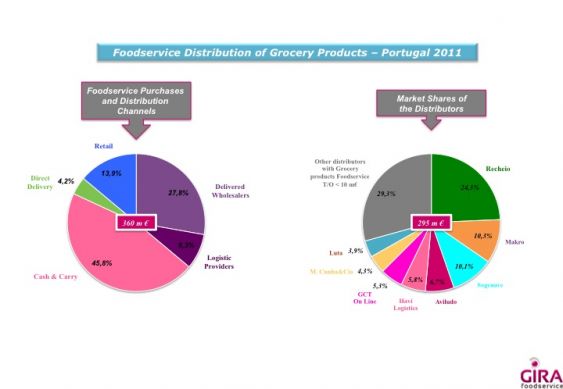

In a complementary report also published in August 2012 so called Foodservice Distribution Portugal 2012, GIRA Foodservice provides key figures about food purchases in the foodservice market in Portugal as well as information on the foodservice distribution market with detailed profiles about the leading distributors (delivered wholesalers, cash & carry operators, logistic providers).

81% of the purchases in value of the Portuguese foodservice market are generated by the commercial foodservice sector of which the largest share is issued from the table service restaurant segment, largely dominated by the independent operators in Portugal. 63,5% of the purchases made by the foodservice market are food purchases, excluding beverages. The largest share is assigned to the category of fresh/chilled products which represent 64% of food purchases, followed by the grocery products (21%) and the frozen products (15%).

Beverage purchases represented 36,5% of the total amount of foodservice purchases.

The wholesalers are the main partners for the foodservice market supply (around 48% of market share when considering all kind of F&B purchases): their position is particularly strong in the beverages category (62,5%). The logistic providers are particularly present in the frozen food product category because of their clientele portfolio which focuses on key accounts (mainly fast food chains) who are heavy users of such products; however, the logistic providers are badly represented in both beverages and fresh/chilled products. By considering the whole foodservice market supply, logistic providers have a market share of around 4% of all kind of F&B purchases. The cash & carry operators are performing on the grocery product category but are not so well represented in the beverage product category as well as in the fresh/chilled food category. Direct purchases from local producers remain predominant for fresh/chilled products as well as for beverages (wines). Purchases in the retail market are most important mainly for fresh/chilled and grocery products, as well as for beverages.

+33 (0)130 062 223

Trinity, 1 bis Place de la Défense© 2005-2024 GIRA Foodservice | Mentions légales | Privacy | Governance |

Création PMP CONCEPT