Innovative European Foodservice Experts

GIRA Foodservice has been updating every 5 years a multi client study about the structure of the Foodservice Market in Portugal. Our newly published study gives an overview of the Foodservice market in Portugal based on 2016/2017 key facts & figures as well as future trends up to 2020.

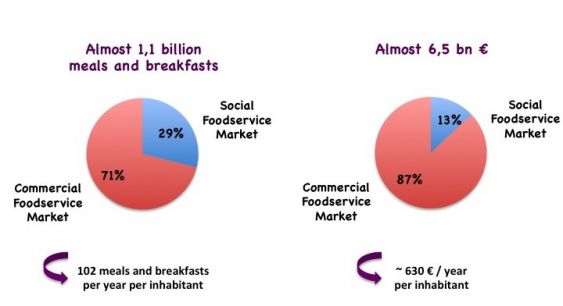

In terms of value, almost 630 euros are spent each year on eating out of home per inhabitant. Over 87% of the total value are generated by the Commercial Foodservice market.

The meals which are consumed out of home represent 14% of all meals eaten by Portuguese people, i.e. an average of 102 meals and snacks per year per inhabitant, which gives another ratio of 2 meals per week. The many insights given by GIRA Foodservice that characterize the Portuguese foodservice market are, by way of example, as follows:

Social Foodservice main highlights: The Association of Hotels, Restaurants and Similar Establishments in Portugal (AHRESP) highlights the importance of social foodservice within the Portuguese economy and it organized the first convention for social foodservice in September 2017 with the presence of several ministers. One of the main trends promoted in social foodservice is to focus on the increase of the quality of food products however with less quantity (problem of infantile obesity). An additional trend is that the State gets rid of activities that are not its core business that may result in a more positive evolution for outsourcing in the public sector. However, even if the situation has positively improved in comparison to 2012, the public sector still has problems

This improvement of the situation is not structured on a solid basis: the consumption is growing however with the money of the banks and this is not a healthy situation on the longer term, there is a need to consolidate the finances of the country….

Commercial Foodservice main highlights: José Avillez famous Portuguese chef: "Being at the table is a very Portuguese tradition. Nothing cheers us more than being in good company to share the dishes that we like the most, accompanied by the best wines and beers, and always with good conversation". This has been actually since the end of 2015/beginning of 2016 that the Portuguese foodservice market has started to pull out from the crisis, driven by the rising tourism industry. The consumers have become less conservative, they want to live an experience, the environment is gaining in importance, the sociability is increasing in the OOH market, people are more positive now.

Examples of new concepts are for instance: new burger concepts, Japanese / Asian food, street food (with a high number of independent snack-based outlets, numerous kiosks in urban areas, pop-up outlets such as vegan points of sale in summer 2017) etc…

Other trendy concepts are linked with a higher consciousness for healthy food:

The AHRESP is mentioning a 10% market share for the number of healthy meals offered in the menus of the commercial foodservice sector with fish and meat dishes representing the lion share of the menus.

Additional concepts offering salads, fish, less fried meals etc…. are additional examples of what can be found increasingly.

Generally speaking, the demand is orientating towards higher quality, a better service, the Portuguese population has been "breeded" correctly now.

Rui SANCHEZ of MULTIFOOD Group: "With a budget of 20 or 25 euros, one can eat better in Lisbon or Porto than in any other city in Europe. As for the high-end segment, there is still a lot to do…."

For more details: GIRA Foodservice / Tel: 0033 (0)4 50 20 16 35

Virginie PERNIN: virginie.pernin@girafoodservice.com

© 2005-2025 GIRA Foodservice | Legal notices | Privacy | Governance |

Design by PMP CONCEPT