Innovative European Foodservice Experts

A traditional market that offers new opportunities for the development of restaurant chains and contracts caterers

GIRA Foodservice has been updating its multi client study about the structure of the Foodservice Market in Belgium. Our newly published study gives an overview of the Foodservice market in Belgium based on 2011/2012 key facts & figures as well as future trends up to 2015.

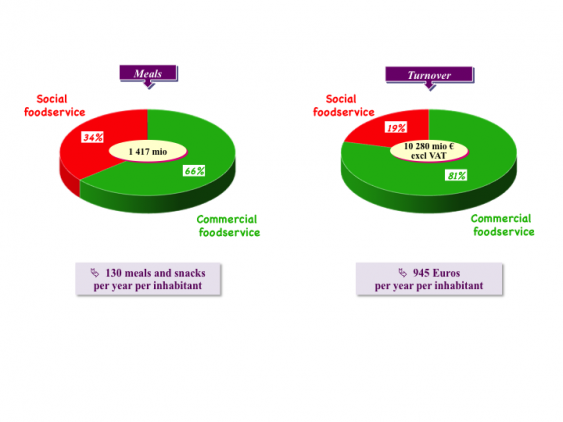

In terms of value, 945 euros are spent each year on eating out of home per inhabitant. 81% of the total value are generated by the Commercial Foodservice market.

The meals which are consumed out of home represent an average of 130 meals and snacks per year per inhabitant, which gives another ratio of 2,5 meals per week.

Despite appearances, this close cousin to France has kept its own specificities: an out of home consumption superior to the French average, singular concepts like the friteries, a low level of representation of the education sector in the social foodservice…Moreover, the plurality of its communities and of its consumption habits makes it a unique market.

SOCIAL FOODSERVICE

The share of the social foodservice is declining as the commercial foodservice is developing. The healthcare and welfare sectors, core sectors of the social foodservice are the motor of the growth (2/3 of the additional meals in the social FS between 2008 and 2011, 89% between 2011 and 2015). The B&I sector position is weakening with the decline of the manufacturing industry and the transfer of administrations to communities. However, the dynamism of the service sector and the development of adapted foodservice infrastructures to the new types of consumption enable to maintain the level of activity. The education sector moderate growth is mainly linked to the development of the further education segments, the other segments being relatively stable.

Social foodservice represents a market of opportunities for contract caterers with segments still underexploited like average size companies, administrations, services for elders or prisons.

COMMERCIAL FOODSERVICE

The share of the commercial foodservice is increasing. The major contribution to the evolution of the market in volume is linked to the quick service sector (62% of the additional meals in the commercial foodservice sector between 2008 and 2011 and 50% between 2011 and 2015) with average growth rates that remain above the other sector. However, the importance of the table service sector in value and the strong attachment of Belgians to this formula influence the market. Despite the 2009 gap and the weakening of the cafe restaurants segment, evolutions are positive thanks to the solidity of the traditional segment and the dynamism of themed restaurants. The transport sector will return to a positive trend after a difficult period during the economic crisis. Other on-site foodservice activity will continue on their current moderate growth trends.

Restaurants chains are under represented on the Belgium market, in particular on the traditional and themed restaurants segments where they are facing the strong competition of independents. The Belgium market although up to now quite conventional and loyal to the traditional cuisine, is calling for innovative concepts. Over the last few years, several new entrants, in particular quick service concepts, have started an activity in the kingdom.

To capture the structure and specificities of the Belgium foodservice market, anticipate the future changes, contact us at agnes.barril@girafoodservice.com and subscribe to our publication Foodservice Belgium.

In addition to this Foodservice Belgium report, GIRA has also published two additional reports to complete the knowledge of the market:

•• 19 Contract caterers

•• 9 Table service restaurants chains

•• 4 Self service restaurants chains

•• 33 Quick service restaurants chains

•• 4 Transport operators.

+33 (0)450 201 635

18, avenue Marcel Anthonioz - BP 28 - 01220 Divonne-les-Bains - France Find us on© 2005-2010 GIRA Foodservice | Legal notices | Privacy | Governance |

Design by PMP Concept